Expertise

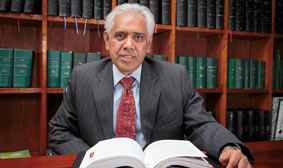

Moorari GUJADHUR

Moorari specialises in all aspects of corporate/ commercial law with a strong track record in banking & finance, capital markets, investment funds and insolvency & restructuring.

Moorari specialises in all aspects of corporate/ commercial law with a strong track record in banking & finance, capital markets, investment funds and insolvency & restructuring.

In addition to having led a number of award-winning transactions, Moorari is also recognised by his peers as a sharp and tough commercial litigator who has successfully conducted a number of challenging cases involving amongst others, complex issues of enforcement of security. Clients also regularly look to Moorari to advise on complex commercial disputes and arbitrations.

EDUCATION

Moorari graduated in Law from the University of Buckingham in 1985 and was called to the Bar of England and Wales and to the Bar of Mauritius in 1987.

AREAS OF PRACTICE

Moorari’s practice is predominantly corporate/commercial, both at the domestic and international level.

CAREER

Moorari began his legal career in Mauritius in the Chambers of Sir Hamid Moollan Q.C. before joining Madun Gujadhur Chambers in May 1995.

Moorari has been Mauritian counsel to :

- a number of major investment projects in south-east Asia and Africa, including Indian power and telecommunications projects and Indonesian banking projects.

- Asia Pulp & Paper Limited and Golden Agri Resources, the first Mauritian company to be listed on the Singapore Stock Exchange.

- the US$500 million acquisition of a bank in Indonesia, which transaction was nominated for an Asian M&A deal of the year award in 2003.

- the Metalform LBO acquisition financing, the then largest leveraged buyout in Singapore and the largest private equity acquisition in Singapore since Yellow Pages, which transaction was nominated for a Singapore M&A deal of the year award in 2004.

- a number of investment funds (portfolio, private equity and venture capital) including The HSBC Private Equity India Fund Limited, The Indian Index Fund (Axa Rosenberg) and funds for CX Partners and Baer Capital.

Moorari has advised the first international share and note offerings using Mauritian issuing vehicles and he successfully lobbied for a change in Mauritian law to make such offerings possible.

He is regularly instructed for promoters and lenders including international finance agencies and international investment banks, and works with many of the leading international law firms including Allen & Overy, Baker & McKenzie, Clearys, Clifford Chance, Cravath, Davis Polk, Freshfields, Jones Day, Linklaters, Milbank, O’Melveny & Myers, Richards Butler, Shearman & Sterling, Skadden and White & Case.

Moorari has also been the standing legal advisor to the Municipal Council of the City of Port Louis, the capital city of Mauritius, and in that capacity advised extensively on the drafting of subsidiary legislation in regard to local government law and has considerable experience of negotiating with and advising government representatives.

He has been Mauritian counsel to IATA and is currently counsel to the Mauritian National Olympic Committee.

Moorari was the Chairman of the Mauritius Bar Association in 2007.

Outside the legal world, he has been Chairman of the Mauritius Housing Corporation and the National Housing Development Corporation.

HIS ADDED VALUE

- Over 20 years’ expertise in advising leading investment banks, commercial banks and other financial institutions and multinational corporates on cross-border financing transactions.

- In-depth knowledge of investment funds and regularly acts as Mauritian counsel to leading private equity houses, investment managers and promoters.

- Recognised as always providing commercially-sound and solution-oriented legal advice.

- Recognised as a key-player on both contentious and non-contentious matters.

MEMBERSHIP

Inns of Court – Middle Temple